Grunnleggende statistikk

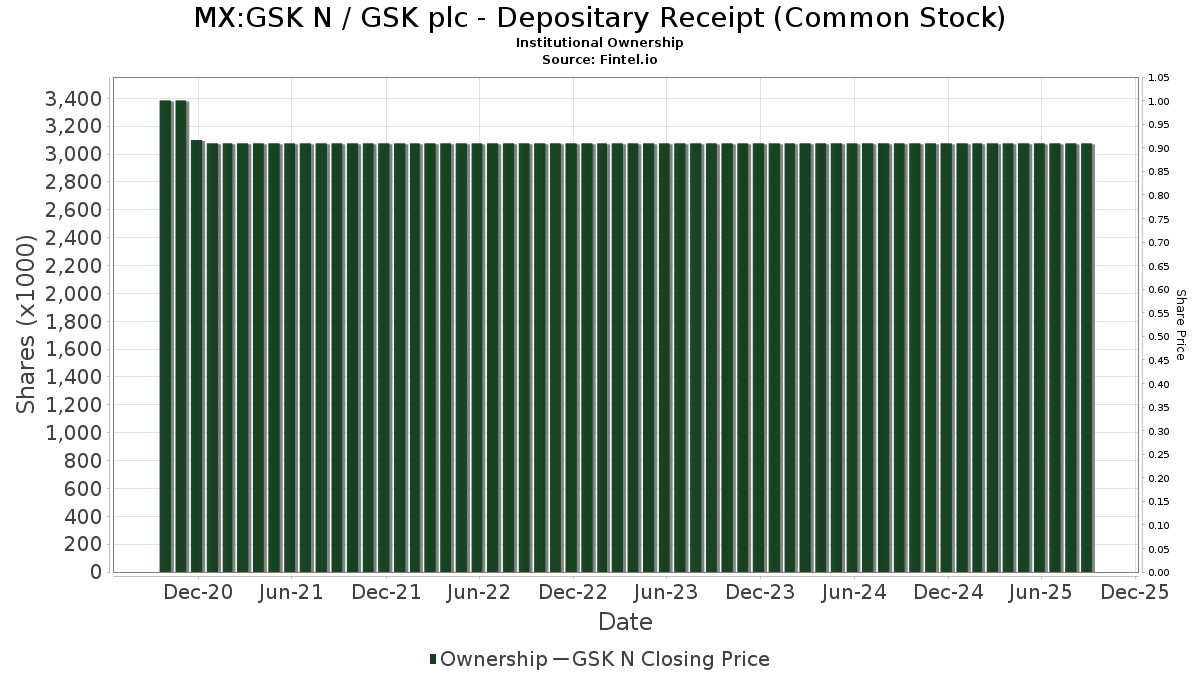

| Institusjonelle eiere | 1057 total, 1040 long only, 1 short only, 16 long/short - change of −4,35% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.2588 % - change of −16,87% MRQ |

| Institusjonelle aksjer (Long) | 488 755 134 (ex 13D/G) - change of −0,31MM shares −9,10% MRQ |

| Institusjonell verdi (Long) | $ 17 643 882 USD ($1000) |

Institusjonelt eierskap og aksjonærer

GSK plc - Depositary Receipt (Common Stock) (MX:GSK N) har 1057 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 488,760,735 aksjer. De største aksjonærene inkluderer Dodge & Cox, Fmr Llc, DODGX - Dodge & Cox Stock Fund, Fisher Asset Management, LLC, Primecap Management Co/ca/, VPMCX - Vanguard PRIMECAP Fund Investor Shares, JTC Employer Solutions Trusteee Ltd, Royal Bank Of Canada, Price T Rowe Associates Inc /md/, and FCTDX - Strategic Advisers Fidelity U.S. Total Stock Fund .

GSK plc - Depositary Receipt (Common Stock) (BMV:GSK N) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 1216 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | 13F | Lsv Asset Management | 25 000 | 9,84 | 1 | |||||

| 2025-07-29 | 13F | Yoffe Investment Management, LLC | 13 657 | 0,00 | 524 | −0,95 | ||||

| 2025-08-05 | 13F | Hills Bank & Trust Co | 30 320 | 8,60 | 1 164 | 7,68 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 10 051 | 0,16 | 386 | −0,77 | ||||

| 2025-07-14 | 13F | Seed Wealth Management, Inc. | 7 100 | −5,59 | 273 | −6,53 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 21 782 | −12,13 | 836 | −12,92 | ||||

| 2025-07-30 | 13F | Citizens & Northern Corp | 41 436 | 3,62 | 1 591 | 2,71 | ||||

| 2025-07-14 | 13F | Opal Wealth Advisors, LLC | 1 474 | 57 | ||||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 5 696 | 2,89 | 219 | 1,87 | ||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Keystone Financial Group | 9 066 | −0,31 | 348 | −1,14 | ||||

| 2025-08-14 | 13F | Syon Capital Llc | 27 424 | 2,56 | 1 053 | 1,74 | ||||

| 2025-08-13 | 13F | Sanibel Captiva Trust Company, Inc. | 12 525 | −1,66 | 481 | −2,64 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 18 763 | −47,57 | 720 | −48,05 | ||||

| 2025-07-16 | 13F | Advisors Management Group Inc /adv | 90 041 | −1,26 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Icon Advisers Inc/co | 35 800 | 0,00 | 1 375 | −0,87 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | Put | 0 | −100,00 | 0 | ||||

| 2025-08-15 | NP | MBEQX - M International Equity Fund | 6 435 | 0,00 | 247 | −0,80 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 1 868 949 | 21,47 | 71 768 | 20,40 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 4 059 | 156 | ||||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 69 468 | 80,82 | 2 668 | 105,31 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 79 800 | 353,41 | 3 064 | 349,93 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 290 700 | 339,79 | 11 163 | 336,02 | |||

| 2025-08-22 | NP | FGLGX - Fidelity Series Large Cap Stock Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 811 128 | 0,00 | 146 347 | −0,88 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 20 965 | −5,07 | 805 | −5,85 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 401 777 | 1,22 | 15 444 | 0,33 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 10 589 | 67,65 | 407 | 66,39 | ||||

| 2025-07-30 | 13F/A | Old Point Trust & Financial Services N A | 560 | −32,37 | 22 | −34,37 | ||||

| 2025-04-29 | 13F | Wood Tarver Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | LMR Partners LLP | Put | 32 700 | 1 256 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1 270 | −50,97 | 49 | −52,00 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 384 302 | 0,00 | 14 757 | −0,87 | ||||

| 2025-07-30 | 13F | Canal Insurance CO | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | PCLVX - PACE Large Co Value Equity Investments Class P | 21 164 | −7,44 | 843 | 4,59 | ||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 16 626 | −0,53 | 638 | −1,39 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 121 249 | 28,22 | 5 | 33,33 | ||||

| 2025-06-26 | NP | FBCV - Fidelity Blue Chip Value ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 46 608 | −0,25 | 1 857 | 12,68 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 17 700 | 0,00 | 680 | −0,88 | ||||

| 2025-05-02 | 13F | Napatree Capital Llc | 10 276 | −10,79 | 398 | 2,31 | ||||

| 2025-05-15 | 13F | Parallax Volatility Advisers, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 12 900 | 4,23 | 495 | 3,34 | ||||

| 2025-07-10 | 13F | Tompkins Financial Corp | 100 | 0,00 | 4 | 0,00 | ||||

| 2025-07-24 | NP | FPHAX - Pharmaceuticals Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 386 160 | −18,04 | 56 874 | −10,54 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 10 255 | −3,53 | 394 | −4,38 | ||||

| 2025-05-15 | 13F | Parallax Volatility Advisers, L.P. | Call | 0 | −100,00 | 0 | ||||

| 2025-07-22 | 13F | Old National Bancorp /in/ | 10 180 | 11,79 | 391 | 10,80 | ||||

| 2025-08-12 | 13F | Aviso Financial Inc. | 7 954 | 8,20 | 305 | 7,39 | ||||

| 2025-07-22 | 13F | Signature Wealth Management Partners, LLC | 7 504 | 0,00 | 288 | −0,69 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 31 849 | 10,68 | 1 223 | 9,78 | ||||

| 2025-08-13 | 13F | VestGen Advisors, LLC | 84 675 | −4,69 | 3 191 | −7,29 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust II - Brighthouse/Wellington Balanced Portfolio Class A | 39 572 | 0,00 | 1 520 | −0,91 | ||||

| 2025-07-18 | 13F | New Wave Wealth Advisors Llc | 8 913 | 0,54 | 342 | −0,29 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 6 568 | 8,49 | 252 | 7,69 | ||||

| 2025-08-13 | 13F | Causeway Capital Management Llc | 1 107 076 | −0,08 | 42 512 | −0,95 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 13 142 | −1,77 | 505 | −2,70 | ||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 822 | 0,00 | 32 | 0,00 | ||||

| 2025-07-28 | NP | AVIV - Avantis International Large Cap Value ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 167 125 | 49,74 | 6 857 | 63,46 | ||||

| 2025-05-15 | 13F | Vestal Point Capital, LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Johnson Financial Group, Inc. | 1 182 | −58,25 | 46 | −59,09 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 374 | −30,74 | 14 | −30,00 | ||||

| 2025-06-23 | NP | UEPIX - Europe 30 Profund Investor Class | 2 920 | 74,02 | 116 | 96,61 | ||||

| 2025-07-30 | 13F | Advantage Trust Co | 240 | 9 | ||||||

| 2025-08-11 | 13F | Traub Capital Management LLC | 16 | 1 | ||||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 6 116 | 235 | ||||||

| 2025-07-09 | 13F | Fiduciary Alliance LLC | 11 846 | 3,56 | 455 | 2,48 | ||||

| 2025-08-27 | NP | HCMAX - Hillman Value Fund | 79 400 | −14,16 | 3 049 | −14,93 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 40 023 | 0,90 | 1 537 | 0,07 | ||||

| 2025-08-05 | 13F | American Assets Investment Management, LLC | 40 000 | 0,00 | 1 536 | −0,84 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 117 595 | −2,01 | 4 763 | −2,30 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 1 100 687 | −12,06 | 42 266 | −12,84 | ||||

| 2025-07-17 | 13F | City Holding Co | 550 | 0,00 | 21 | 0,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 66 634 | 611,60 | 2 559 | 606,63 | ||||

| 2025-07-10 | 13F | Peoples Bank/KS | 5 710 | 13,18 | 219 | 12,31 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 422 500 | −11,07 | 16 224 | −11,85 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 748 800 | 41,07 | 28 754 | 39,83 | |||

| 2025-07-18 | 13F | First Pacific Financial | 620 | −46,55 | 24 | −47,73 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 1 779 776 | 13,67 | 68 343 | 12,67 | ||||

| 2025-08-14 | 13F | AllSquare Wealth Management LLC | 80 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | State Street Corp | 6 714 223 | −3,71 | 260 787 | −4,45 | ||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-29 | 13F | Hm Payson & Co | 1 308 | 79,67 | 51 | 108,33 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 12 862 | 4,81 | 494 | 3,79 | ||||

| 2025-08-29 | NP | GATAX - The Gabelli Asset Fund Class A | 1 200 | 46 | ||||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 11 664 | 9,52 | 448 | 8,50 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 5 471 | 210 | ||||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 755 | 9,58 | 28 | 7,69 | ||||

| 2025-07-23 | 13F | MADDEN SECURITIES Corp | 96 905 | −9,29 | 3 721 | −10,08 | ||||

| 2025-05-16 | 13F | Ckw Financial Group | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Kavar Capital Partners Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Creative Capital Management Investments LLC | 20 | 0,00 | 1 | |||||

| 2025-08-21 | NP | PPH - VanEck Vectors Pharmaceutical ETF | 683 928 | −11,73 | 26 263 | −12,51 | ||||

| 2025-08-14 | 13F | Gluskin Sheff & Assoc Inc | 23 984 | −48,12 | 921 | −48,60 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 189 408 | 22,83 | 7 273 | 21,76 | ||||

| 2025-08-14 | 13F | Hillman Capital Management, Inc. | 152 599 | −7,60 | 5 860 | −8,41 | ||||

| 2025-08-08 | 13F | Creative Planning | 295 356 | 2,46 | 11 342 | 1,56 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 17 675 | −6,96 | 686 | −7,67 | ||||

| 2025-06-18 | NP | REAYX - Equity Income Fund Class Y | 19 280 | −7,64 | 768 | 4,35 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 24 760 | −2,28 | 951 | −3,16 | ||||

| 2025-08-27 | NP | VPCCX - Vanguard PRIMECAP Core Fund Investor Shares | 3 575 560 | 3,63 | 137 302 | 2,72 | ||||

| 2025-08-04 | 13F | AMG National Trust Bank | 8 191 | −88,16 | 315 | −88,28 | ||||

| 2025-08-29 | NP | VELA Funds - VELA Large Cap 130/30 Fund Class I | Short | −5 601 | −215 | |||||

| 2025-05-15 | 13F | Hall Laurie J Trustee | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Cook Wealth Management Group Llc | 0 | −100,00 | 0 | |||||

| 2025-04-28 | 13F | Pinnacle Financial Partners Inc | 10 935 | 1,60 | 424 | 16,21 | ||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 105 | 11,70 | 4 | 33,33 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 22 071 | 10,06 | 801 | 3,09 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 460 | −18,87 | 18 | −19,05 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 46 100 | 307,96 | 1 770 | 305,03 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 38 563 | 1 481 | ||||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 3 200 | 123 | |||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 6 579 | −11,85 | 253 | −12,80 | ||||

| 2025-08-14 | 13F | Tang Capital Management Llc | 400 000 | 0,00 | 15 360 | −0,88 | ||||

| 2025-07-31 | 13F | Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD | 69 099 | 0,00 | 2 685 | −0,70 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 11 255 | 6,95 | 432 | 6,14 | ||||

| 2025-07-11 | 13F | Diversified Trust Co | 9 998 | 3,67 | 384 | 2,68 | ||||

| 2025-08-12 | 13F | Brandywine Global Investment Management, LLC | 1 510 384 | −0,01 | 57 999 | −0,89 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 24 | 0,00 | 1 | |||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 1 707 | 8,80 | 66 | 8,33 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 27 060 | 2,32 | 1 039 | 16,22 | ||||

| 2025-07-28 | 13F | Twin Tree Management, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 9 540 | 0,46 | 366 | −0,27 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 6 923 | 13,77 | 266 | 15,22 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Raleigh Capital Management Inc. | 34 988 | 1 344 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 4 779 | 19,21 | 0 | |||||

| 2025-08-12 | 13F | Calton & Associates, Inc. | 7 346 | 1,17 | 282 | 0,36 | ||||

| 2025-06-27 | NP | SUNAMERICA SERIES TRUST - SA Goldman Sachs Multi-Asset Insights Portfolio Class 1 | 6 720 | 0,00 | 268 | 12,66 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 29 385 | 11,84 | 1 128 | 10,91 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 2 385 787 | 639,11 | 91 614 | 632,68 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 29 448 | 38,18 | 1 131 | 36,97 | ||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 21 638 | 7,12 | 831 | 6,14 | ||||

| 2025-07-24 | NP | FEIAX - Fidelity Advisor Equity Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 927 800 | 0,00 | 38 068 | 9,15 | ||||

| 2025-07-07 | 13F | TruWealth Advisors, LLC | 176 811 | 6 790 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | Call | 0 | −100,00 | 0 | ||||

| 2025-07-11 | 13F | First PREMIER Bank | 4 659 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Gts Securities Llc | 10 054 | 73,34 | 386 | 72,32 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | Put | 0 | −100,00 | 0 | ||||

| 2025-07-17 | 13F | Greenleaf Trust | 7 694 | 3,00 | 295 | 2,08 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 14 765 | 3,16 | 567 | 2,17 | ||||

| 2025-07-09 | 13F | First Financial Corp /in/ | 252 | 0,00 | 10 | 0,00 | ||||

| 2025-07-16 | 13F | TOWER TRUST & INVESTMENT Co | 22 902 | 2,79 | 879 | −0,90 | ||||

| 2025-07-31 | 13F | Washington Trust Advisors, Inc. | 1 456 | 0,00 | 56 | −1,79 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 8 577 017 | 13,14 | 329 357 | 12,14 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 47 068 | 10,70 | 1 807 | 9,71 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 200 | 8 | ||||||

| 2025-08-05 | 13F | Key FInancial Inc | 560 | 22 | ||||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 2 410 | 0,00 | 94 | −1,06 | ||||

| 2025-07-15 | 13F | Missouri Trust & Investment Co | 5 500 | 0,00 | 211 | −0,94 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 593 048 | −26,47 | 22 773 | −27,11 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 9 610 | 369 | ||||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 92 | 4 | ||||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Put | 11 200 | 430 | |||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Parvin Asset Management, LLC | 200 | 0,00 | 8 | 0,00 | ||||

| 2025-08-14 | 13F | Fiduciary Trust Co | 16 400 | 3,67 | 630 | 2,78 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 6 921 | 23,26 | 266 | 22,12 | ||||

| 2025-07-15 | 13F | Cranbrook Wealth Management, LLC | 508 | 0,00 | 20 | 0,00 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Call | 43 700 | 562,12 | 1 678 | 558,04 | |||

| 2025-07-14 | 13F | GAMMA Investing LLC | 6 153 | 38,36 | 236 | 37,21 | ||||

| 2025-07-17 | 13F | Catalytic Wealth RIA, LLC | 16 174 | 0,85 | 621 | 0,00 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 112 800 | 371,97 | 4 332 | 368,22 | |||

| 2025-07-29 | 13F | Hourglass Capital, Llc | 130 589 | 10,51 | 5 015 | 9,55 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Put | 473 100 | 34,98 | 18 167 | 33,80 | |||

| 2025-08-14 | 13F | Millennium Management Llc | 78 427 | 168,69 | 3 012 | 166,46 | ||||

| 2025-08-28 | NP | MEDX - Horizon Kinetics Medical ETF | 10 792 | −4,20 | 414 | −5,05 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 593 | 148,91 | 61 | 154,17 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 83 142 | 18,33 | 3 193 | 17,31 | ||||

| 2025-07-07 | 13F | Enterprise Bank & Trust Co | 24 455 | −0,65 | 939 | −1,47 | ||||

| 2025-05-22 | NP | RODM - Hartford Multifactor Developed Markets (ex-US) ETF | 285 759 | 18,34 | 11 070 | 35,56 | ||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 201 452 | 28,88 | 7 736 | 27,75 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 18 013 | −5,68 | 692 | −6,50 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 543 | −10,84 | 21 | −13,04 | ||||

| 2025-08-13 | 13F | ESL Trust Services, LLC | 2 500 | 0,00 | 96 | 0,00 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 8 046 392 | 4,20 | 309 | 3,01 | ||||

| 2025-07-18 | 13F | RKL Wealth Management LLC | 7 083 | 0,00 | 272 | −1,09 | ||||

| 2025-05-01 | 13F | Quest 10 Wealth Builders, Inc. | 240 | −18,92 | 9 | 0,00 | ||||

| 2025-07-18 | 13F | Ami Asset Management Corp | 17 870 | −0,56 | 686 | −1,44 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 80 420 | −67,50 | 3 088 | −67,79 | ||||

| 2025-07-21 | 13F | Compass Planning Associates Inc | 217 | 1,40 | 8 | 0,00 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 58 089 | −15,86 | 2 231 | −16,60 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 25 921 | 37,58 | 1 | |||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 354 991 | −3,28 | 14 | −7,14 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 530 | −66,65 | 20 | −62,26 | ||||

| 2025-07-24 | 13F | Thompson Investment Management, Inc. | 1 420 | −39,21 | 55 | −40,00 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 1 820 | 141,06 | 70 | 137,93 | ||||

| 2025-06-27 | NP | AADEX - American Beacon Large Cap Value Fund Institutional Class | 131 915 | −20,16 | 5 257 | −9,80 | ||||

| 2025-08-15 | 13F | Auxier Asset Management | 28 542 | −1,06 | 1 096 | −1,88 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 7 187 | −57,84 | 276 | −52,67 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 26 745 | 14,81 | 1 027 | 13,86 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 13 129 | 30,73 | 504 | 29,56 | ||||

| 2025-06-26 | NP | FFLC - Fidelity New Millennium ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 101 116 | 1,00 | 4 029 | 14,14 | ||||

| 2025-07-25 | 13F | Richardson Financial Services Inc. | 957 | 13,79 | 37 | 15,63 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 20 000 | 768 | ||||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 4 198 828 | 275,53 | 161 235 | 272,24 | ||||

| 2025-08-14 | 13F | Dymon Asia Capital (singapore) Pte. Ltd. | 26 500 | 47,22 | 1 018 | 45,91 | ||||

| 2025-07-15 | 13F | Foster Victor Wealth Advisors, LLC | 363 694 | 3,23 | 14 199 | 16,34 | ||||

| 2025-07-22 | 13F | Clarius Group, LLC | 6 092 | 0,00 | 234 | −1,27 | ||||

| 2025-07-09 | 13F | Gilman Hill Asset Management, LLC | 118 875 | 70,16 | 4 565 | 68,66 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 11 399 | −43,09 | 438 | −43,61 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 18 408 | 9,07 | 707 | 8,12 | ||||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Regions Financial Corp | 31 224 | 4,68 | 1 199 | 3,81 | ||||

| 2025-07-07 | 13F | Investors Research Corp | 18 628 | 0,00 | 715 | −0,83 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 11 923 | 0,00 | 458 | −0,87 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 85 080 | 11,00 | 3 267 | 10,04 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 95 343 | 22,82 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 8 205 | 21,04 | 315 | 20,23 | ||||

| 2025-05-22 | NP | RODE - Hartford Multifactor Diversified International ETF | 4 181 | 2,27 | 162 | 16,67 | ||||

| 2025-07-08 | 13F | Gallacher Capital Management LLC | 12 573 | 2,86 | 483 | 1,90 | ||||

| 2025-08-05 | 13F | Welch & Forbes Llc | 519 365 | 0,00 | 19 944 | −0,88 | ||||

| 2025-08-13 | 13F | Capital Research Global Investors | 1 776 812 | 0,83 | 68 230 | −0,05 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 68 204 | 32,40 | 2 619 | 31,28 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 23 978 | −4,68 | 921 | −5,54 | ||||

| 2025-07-17 | 13F | Sage Rhino Capital Llc | 6 612 | 3,52 | 254 | 2,43 | ||||

| 2025-08-26 | NP | FVD - First Trust Value Line Dividend Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 986 043 | −6,82 | 37 864 | −7,64 | ||||

| 2025-06-26 | NP | FLCSX - Fidelity Large Cap Stock Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 058 501 | 13,60 | 42 181 | 28,35 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 325 | 23,11 | 12 | 20,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 5 068 687 | 99,81 | 194 638 | 98,06 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | Put | 0 | −100,00 | 0 | ||||

| 2025-07-23 | 13F | Citizens National Bank Trust Department | 1 081 | 0,00 | 42 | 0,00 | ||||

| 2025-08-19 | NP | GIDHX - Goldman Sachs International Equity Dividend and Premium Fund Institutional | 31 029 | 0,00 | 1 192 | −0,92 | ||||

| 2025-08-13 | 13F | Alerus Financial Na | 1 259 | 48 | ||||||

| 2025-08-07 | 13F | Winch Advisory Services, LLC | 512 | 1,19 | 20 | 0,00 | ||||

| 2025-08-14 | 13F | Hotchkis & Wiley Capital Management Llc | 4 556 621 | −1,76 | 174 974 | −2,62 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 167 | 6 | ||||||

| 2025-07-17 | 13F | Hanson & Doremus Investment Management | 2 706 | 92,32 | 0 | |||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 22 908 | −2,44 | 880 | −3,30 | ||||

| 2025-08-14 | 13F | Hara Capital LLC | 134 | 0,00 | 5 | 0,00 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 11 514 | 0,19 | 442 | −0,67 | ||||

| 2025-06-26 | NP | DFALX - Large Cap International Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 363 225 | 0,00 | 14 475 | 12,99 | ||||

| 2025-07-16 | 13F | Kooman & Associates | 7 834 | 37,63 | 301 | 36,36 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 1 140 | 0,09 | 44 | −2,27 | ||||

| 2025-08-26 | NP | GMOI - GMO International Value ETF | 86 855 | 130,86 | 3 335 | 128,89 | ||||

| 2025-08-07 | 13F | HighPoint Advisor Group LLC | 14 478 | 20,18 | 556 | 18,34 | ||||

| 2025-08-27 | NP | RYEUX - Europe 1.25x Strategy Fund Class H | 355 | −85,14 | 14 | −85,87 | ||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 7 193 | 19,56 | 295 | 30,53 | ||||

| 2025-07-28 | 13F | Bayforest Capital Ltd | 6 324 | 243 | ||||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 88 264 | 126,75 | 3 394 | 125,37 | ||||

| 2025-08-13 | 13F | Haverford Trust Co | 73 259 | −0,70 | 2 813 | −1,54 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 97 412 | 7,44 | 3 741 | 6,49 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 67 962 | −39,85 | 2 610 | −40,39 | ||||

| 2025-05-14 | 13F | Wall Street Access Asset Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 159 588 | 13,11 | 6 157 | 15,22 | ||||

| 2025-08-14 | 13F | SALT Holding Corp. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 823 | 0,00 | 32 | 0,00 | ||||

| 2025-08-26 | 13F | Provident Investment Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Old North State Wealth Management, LLC | 14 769 | 2,95 | 568 | 1,98 | ||||

| 2025-07-11 | 13F | Lantz Financial LLC | 10 131 | 389 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 21 830 | −3,36 | 838 | −4,23 | ||||

| 2025-06-27 | NP | POSKX - PRIMECAP Odyssey Stock Fund | 1 146 850 | −1,80 | 45 702 | 10,95 | ||||

| 2025-05-14 | 13F | FORA Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Kranot Hishtalmut Le Morim Ve Gananot Havera Menahelet LTD | 201 301 | 0,00 | 7 821 | −0,69 | ||||

| 2025-08-14 | 13F | UBS Group AG | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-13 | 13F | Employees Retirement System of Texas | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Health Care Fund Variable Annuity | 1 621 | −31,95 | 62 | −32,61 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 2 348 | 0,00 | 91 | 0,00 | ||||

| 2025-07-11 | 13F | Bell Bank | 186 766 | −4,26 | 7 172 | −5,11 | ||||

| 2025-07-21 | 13F | Exchange Capital Management, Inc. | 33 503 | 238,96 | 1 287 | 236,65 | ||||

| 2025-07-30 | 13F | Probity Advisors, Inc. | 23 685 | 23,35 | 910 | 22,34 | ||||

| 2025-07-29 | 13F | Stanley-Laman Group, Ltd. | 97 844 | −20,79 | 3 757 | −21,48 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 3 155 | −10,72 | 121 | −11,03 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 1 055 | −79,37 | 41 | −79,80 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 143 760 | 2,61 | 5 520 | 1,71 | ||||

| 2025-08-08 | 13F | Union Savings Bank | 2 641 | 0,00 | 98 | −3,92 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 6 102 | −5,34 | 234 | −6,02 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 971 | 37 | ||||||

| 2025-08-13 | 13F | Greenwich Wealth Management LLC | 31 899 | 0,00 | 1 | 0,00 | ||||

| 2025-08-06 | 13F | Cetera Trust Company, N.A | 6 995 | 5,66 | 269 | 4,69 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 155 719 | 2,98 | 6 | 0,00 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 1 582 | 0,00 | 61 | −1,64 | ||||

| 2025-08-14 | 13F | Eversept Partners, LP | 2 242 388 | −14,52 | 86 108 | −15,27 | ||||

| 2025-07-16 | 13F | American National Bank | 1 300 | 50 | ||||||

| 2025-05-12 | 13F | Sandy Spring Bank | 765 | −46,76 | 30 | −39,58 | ||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 47 705 | 1,73 | 1 832 | 0,83 | ||||

| 2025-08-25 | NP | IOEZX - ICON EQUITY INCOME FUND Institutional Class | 35 800 | 0,00 | 1 375 | −0,87 | ||||

| 2025-08-14 | 13F | Sphera Funds Management Ltd. | 122 000 | −6,15 | 4 685 | −6,99 | ||||

| 2025-06-26 | NP | FCLKX - Fidelity Large Cap Stock K6 Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 12 375 | 6,00 | 493 | 19,95 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 604 229 | −1,03 | 61 602 | −1,90 | ||||

| 2025-07-16 | 13F | St Germain D J Co Inc | 1 704 | 225,19 | 65 | 225,00 | ||||

| 2025-07-30 | 13F | IMG Wealth Management, Inc. | 549 | 21 | ||||||

| 2025-07-29 | 13F | Tweedy, Browne Co LLC | 86 871 | −4,06 | 3 336 | −4,90 | ||||

| 2025-08-13 | 13F | WealthTrust Axiom LLC | 72 774 | −0,91 | 2 795 | −1,79 | ||||

| 2025-08-12 | 13F | YANKCOM Partnership | 86 | 0,00 | 3 | 0,00 | ||||

| 2025-09-12 | 13F/A | Valeo Financial Advisors, LLC | 13 079 | 3,79 | 502 | 2,87 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 2 124 | 47,09 | 82 | 47,27 | ||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 140 | 5 | ||||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Herold Advisors, Inc. | 10 433 | 6,47 | 401 | 5,54 | ||||

| 2025-07-29 | NP | GTMIX - GMO Tax-Managed International Equities Fund Class III | 160 101 | 15,55 | 6 569 | 26,11 | ||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 6 697 | 35,35 | 267 | 52,87 | ||||

| 2025-06-26 | NP | FDWM - Fidelity Women's Leadership ETF | 1 168 | −12,57 | 47 | −2,13 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 3 320 | −2,12 | 128 | −3,05 | ||||

| 2025-07-22 | 13F | DT Investment Partners, LLC | 1 331 | 0,00 | 51 | 0,00 | ||||

| 2025-07-29 | NP | NIAGX - Nia Impact Solutions Fund | 38 161 | 1 566 | ||||||

| 2025-05-15 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Atlantic Trust, LLC | 1 527 | 9,94 | 59 | 9,43 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 665 | 25 | ||||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 12 283 | 5,16 | 472 | 4,20 | ||||

| 2025-09-11 | 13F | Silicon Valley Capital Partners | 76 | 3 | ||||||

| 2025-07-25 | 13F | Cerro Pacific Wealth Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Parallax Volatility Advisers, L.P. | Put | 0 | −100,00 | 0 | ||||

| 2025-07-14 | 13F | Abound Wealth Management | 18 | 0,00 | 1 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 3 535 836 | 65,51 | 135 775 | 64,06 | ||||

| 2025-08-12 | 13F | OneAscent Financial Services LLC | 6 423 | −16,58 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 8 926 | 15,86 | 343 | 18,75 | ||||

| 2025-08-13 | 13F | GM Advisory Group, Inc. | 5 431 | 1,19 | 209 | 0,48 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 14 738 | 4,76 | 572 | 4,00 | ||||

| 2025-06-26 | NP | FGRIX - Fidelity Growth & Income Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 803 675 | 23,50 | 111 726 | 39,54 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 238 991 | −4,27 | 9 152 | −5,43 | ||||

| 2025-08-14 | 13F | Fmr Llc | 61 003 544 | 1,47 | 2 342 536 | 0,58 | ||||

| 2025-07-30 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 760 | 0,00 | 29 | 3,57 | ||||

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 482 | 0,00 | 19 | 0,00 | ||||

| 2025-07-14 | 13F | S.A. Mason LLC | 640 | 0,00 | 25 | 0,00 | ||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 10 383 | 1,78 | 403 | 1,00 | ||||

| 2025-08-18 | 13F | Rexford Capital Inc | 6 376 | 245 | ||||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 26 015 | −30,78 | 999 | −31,41 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 18 316 | −7,44 | 703 | −8,22 | ||||

| 2025-07-02 | 13F | InvesTrust | 31 517 | −69,87 | 1 210 | −70,14 | ||||

| 2025-07-25 | 13F | M.e. Allison & Co., Inc. | 11 270 | 4,49 | 433 | 3,60 | ||||

| 2025-06-26 | NP | FNKLX - Fidelity Series Value Discovery Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 376 300 | −1,58 | 174 396 | 11,20 | ||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 278 | 0,00 | 11 | 0,00 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 1 295 | −7,89 | 50 | −9,26 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | Put | 50 900 | 41,78 | 1 955 | 40,58 | |||

| 2025-08-14 | 13F | Verition Fund Management LLC | Call | 14 900 | 53,61 | 572 | 52,53 | |||

| 2025-08-13 | 13F | Bridgewater Associates, LP | 1 344 042 | 11,72 | 51 611 | 10,74 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 13 216 | −74,99 | 507 | −75,23 | ||||

| 2025-05-29 | NP | JHFEX - John Hancock Fundamental Equity Income Fund Class I | 9 320 | −10,78 | 361 | 2,27 | ||||

| 2025-07-11 | 13F | Bond & Devick Financial Network, Inc. | 6 430 | 20,64 | 247 | 19,42 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 14 112 | 19,92 | 542 | 18,90 | ||||

| 2025-05-15 | 13F | D. E. Shaw & Co., Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-07 | 13F | Douglas Lane & Associates, LLC | 1 317 109 | −13,43 | 50 577 | −14,19 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 34 101 | 470,44 | 1 309 | 466,67 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 12 131 | 34,21 | 466 | 32,86 | ||||

| 2025-08-12 | 13F | Bedel Financial Consulting, Inc. | 7 562 | 0,00 | 290 | 2,47 | ||||

| 2025-07-17 | 13F | Alpine Bank Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 54 865 | 1,80 | 2 125 | 16,63 | ||||

| 2025-07-29 | NP | BLUIX - BLUEPRINT GROWTH FUND Institutional Class | 10 738 | 441 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 5 238 287 | −33,46 | 201 150 | −34,04 | ||||

| 2025-07-29 | NP | WEUSX - Siit World Equity Ex-us Fund - Class A | 8 283 | 340 | ||||||

| 2025-08-11 | 13F | Primecap Management Co/ca/ | 27 726 780 | 7,85 | 1 064 708 | 6,91 | ||||

| 2025-08-28 | NP | SLGAX - SIMT Large Cap Fund Class F | 94 516 | −17,92 | 3 629 | −18,63 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 366 | −32,47 | 14 | −33,33 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 25 825 | 141,58 | 992 | 139,37 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 68 760 | 10,86 | 2 640 | 9,91 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 6 653 | −0,34 | 255 | −1,16 | ||||

| 2025-07-28 | 13F | Twin Tree Management, LP | Put | 26 800 | 1 029 | |||||

| 2025-07-28 | 13F | Twin Tree Management, LP | Call | 557 600 | 93,75 | 21 412 | 92,04 | |||

| 2025-04-29 | 13F | Callan Capital, LLC | 13 401 | 38,34 | 519 | 58,72 | ||||

| 2025-07-16 | 13F | Stephenson National Bank & Trust | 404 | −3,12 | 16 | −6,25 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 254 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | Put | 40 000 | −73,33 | 1 536 | −73,57 | |||

| 2025-07-31 | 13F | WFA Asset Management Corp | 733 | 1,10 | 28 | −9,68 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 81 442 | 2,86 | 3 127 | 1,96 | ||||

| 2025-07-16 | 13F | Dakota Wealth Management | 5 428 | 208 | ||||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 508 | −1,93 | 20 | 11,76 | ||||

| 2025-08-11 | 13F | Intrust Bank Na | 11 002 | 422 | ||||||

| 2025-08-15 | 13F | ROSS\JOHNSON & Associates LLC | 24 | 0,00 | 1 | |||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 724 | 0,00 | 28 | 16,67 | ||||

| 2025-05-14 | 13F | Hudson Bay Capital Management LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Jacobi Capital Management LLC | 11 146 | 0,93 | 428 | 0,23 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 9 579 | −6,84 | 368 | −7,79 | ||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 25 681 | 7,88 | 986 | 6,94 | ||||

| 2025-08-14 | 13F | Waters Parkerson & Co., Llc | 13 244 | −8,31 | 509 | −9,12 | ||||

| 2025-08-29 | NP | JHCMX - John Hancock Fundamental Equity Income Fund Class R6 | 9 423 | 362 | ||||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 59 215 | −27,66 | 2 | −33,33 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 751 | 29 | ||||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 77 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Dearborn Partners Llc | 21 392 | 16,31 | 821 | 15,31 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 66 952 | 6,95 | 2 569 | 5,85 | ||||

| 2025-07-07 | 13F | First Community Trust Na | 160 | 0,00 | 6 | 0,00 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 48 852 | 4,67 | 1 896 | 3,72 | ||||

| 2025-08-13 | 13F | Estabrook Capital Management | 1 443 | 0,00 | 55 | 0,00 | ||||

| 2025-08-14 | 13F | Bayesian Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 30 709 | 38,87 | 1 179 | 37,73 | ||||

| 2025-08-12 | 13F | Minot DeBlois Advisors LLC | 600 | 0,00 | 23 | 0,00 | ||||

| 2025-08-01 | 13F | Oarsman Capital, Inc. | 6 669 | 1,75 | 256 | 1,19 | ||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 640 | 0,00 | 25 | 0,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 368 456 | 28,58 | 14 149 | 27,46 | ||||

| 2025-06-30 | NP | GCOW - Pacer Global Cash Cows Dividend ETF | 1 082 388 | 7,88 | 43 133 | 21,89 | ||||

| 2025-08-14 | 13F | BancorpSouth Bank | 17 484 | 2,97 | 671 | 2,13 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 8 046 | 0,57 | 309 | −0,32 | ||||

| 2025-07-25 | 13F | Pzena Investment Management Llc | 7 510 | 288 | ||||||

| 2025-07-07 | 13F | Bangor Savings Bank | 841 | 0,00 | 32 | 0,00 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 57 025 | −0,51 | 2 209 | 13,98 | ||||

| 2025-08-14 | 13F | Altshuler Shaham Ltd | 47 000 | −17,54 | 1 805 | −18,30 | ||||

| 2025-08-22 | NP | QGI2Q - Growth & Income Portfolio Initial Class | 580 035 | 2,76 | 22 273 | 1,86 | ||||

| 2025-07-31 | 13F | City State Bank | 606 | 0,00 | 23 | 0,00 | ||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 7 241 | 278 | ||||||

| 2025-06-25 | NP | RPGAX - T. Rowe Price Global Allocation Fund, Inc. This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 712 | −3,18 | 188 | 9,36 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 10 235 | 133,62 | 393 | 132,54 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 10 533 | −27,48 | 0 | |||||

| 2025-07-15 | 13F | Colonial River Wealth Management, LLC | 5 618 | 3,16 | 222 | 5,71 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust I - Brighthouse/Wellington Large Cap Research Portfolio Class A | 131 806 | 0,00 | 5 061 | −0,88 | ||||

| 2025-08-18 | 13F | Pacific Center for Financial Services | 115 | 0,00 | 4 | 0,00 | ||||

| 2025-07-25 | 13F | Johnson Investment Counsel Inc | 15 718 | 12,37 | 604 | 11,46 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 1 582 | −0,44 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 107 509 | 166,08 | 4 128 | 163,77 | ||||

| 2025-08-14 | 13F | Camber Capital Management LP | Call | 1 000 000 | 0,00 | 38 400 | −0,88 | |||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 21 994 | −5,55 | 845 | −6,32 | ||||

| 2025-07-23 | 13F/A | Euro Pacific Asset Management, LLC | 213 261 | 0,14 | 8 | 0,00 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 942 | −36,35 | 36 | −36,84 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 31 338 405 | 4,35 | 1 203 395 | 3,43 | ||||

| 2025-06-18 | NP | NWFAX - Nationwide Fund Class A | 148 808 | −16,18 | 5 930 | −5,30 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 832 | 0,00 | 32 | −3,12 | ||||

| 2025-08-14 | 13F | Gen-Wealth Partners Inc | 90 | 0,00 | 3 | 0,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 9 095 | 23,29 | 349 | 22,46 | ||||

| 2025-07-08 | 13F | Ballew Advisors, Inc | 9 759 | 0,01 | 373 | 10,06 | ||||

| 2025-08-28 | NP | SEUIX - Simt Large Cap Value Fund Class I | 105 791 | 0,00 | 4 062 | −0,88 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 32 570 | 8,14 | 1 251 | 7,20 | ||||

| 2025-08-13 | 13F | Qtron Investments LLC | 12 021 | 0,00 | 462 | −0,86 | ||||

| 2025-07-22 | 13F | Checchi Capital Advisers, LLC | 10 913 | −7,64 | 419 | −8,32 | ||||

| 2025-07-16 | 13F | Bonness Enterprises Inc | 41 480 | 0,00 | 1 593 | −0,87 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 2 250 853 | 13,56 | 86 433 | 12,56 | ||||

| 2025-06-18 | NP | HUMDX - Huber Capital Mid Cap Value Fund Investor Class | 3 800 | 0,00 | 151 | 12,69 | ||||

| 2025-08-07 | 13F | Profund Advisors Llc | 18 912 | 3,57 | 726 | 2,69 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-25 | NP | MMIUX - MassMutual Select T. Rowe Price International Equity Fund Class I | 25 185 | −17,11 | 967 | −17,84 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 53 290 | 32,43 | 2 046 | 31,32 | ||||

| 2025-08-27 | NP | FAIEX - PFM Multi-Manager International Equity Fund Institutional Class | 25 275 | −38,10 | 971 | −38,65 | ||||

| 2025-08-14 | 13F | Graney & King, LLC | 2 297 | 1,19 | 88 | 1,15 | ||||

| 2025-06-26 | NP | FSUMX - Fidelity Series Sustainable U.S. Market Fund | 2 105 | 37,13 | 84 | 53,70 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 12 904 | 3,96 | 500 | 7,76 | ||||

| 2025-07-15 | 13F | Cardinal Capital Management | 60 166 | 2,72 | 2 336 | 1,88 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 8 575 | −10,52 | 329 | −11,32 | ||||

| 2025-07-15 | 13F | Carr Financial Group Corp | 14 019 | 1,18 | 538 | 0,37 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 183 292 | −8,35 | 7 038 | −9,16 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 79 030 | 201,45 | 3 | 200,00 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 240 | −28,14 | 9 | −25,00 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Nia Impact Advisors, Llc | 108 696 | −0,30 | 4 174 | −1,18 | ||||

| 2025-07-22 | 13F | Plimoth Trust Co Llc | 6 920 | 0,00 | 266 | −1,12 | ||||

| 2025-07-24 | NP | FALAX - Fidelity Advisor Large Cap Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 300 430 | 0,00 | 12 327 | 9,15 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 2 115 329 | −2,33 | 81 229 | −3,19 | ||||

| 2025-08-19 | 13F/A | Pitcairn Co | 9 657 | −21,85 | 371 | −22,59 | ||||

| 2025-08-13 | 13F | Cary Street Partner Investment Advisory Llc | 1 176 | 15,98 | 45 | 15,38 | ||||

| 2025-07-17 | 13F | Michels Family Financial, LLC | 11 852 | 2,46 | 455 | 1,56 | ||||

| 2025-08-01 | 13F | May Hill Capital, LLC | 9 923 | 5,46 | 381 | 4,67 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 328 742 | 39,97 | 13 | 33,33 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 281 770 | −1,84 | 10 820 | −2,71 | ||||

| 2025-07-24 | 13F | CarsonAllaria Wealth Management, Ltd. | 3 973 | 0,35 | 153 | −0,65 | ||||

| 2025-08-28 | NP | DTLVX - Large Company Value Portfolio Investment Class | 5 861 | −19,28 | 225 | −19,93 | ||||

| 2025-07-17 | 13F | Park Place Capital Corp | 10 240 | 388,55 | 399 | 391,36 | ||||

| 2025-07-08 | 13F | Rise Advisors, LLC | 9 | 350,00 | 0 | |||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 223 419 | 234,50 | 8 579 | 231,62 | ||||

| 2025-06-18 | NP | RSEAX - U.S. Strategic Equity Fund Class A | 148 254 | 0,00 | 5 908 | 12,99 | ||||

| 2025-07-16 | 13F | Kendall Capital Management | 25 446 | 76,76 | 977 | 75,40 | ||||

| 2025-06-18 | NP | HUDIX - Huber Capital Diversified Large Cap Value Fund Investor Class | 2 400 | 0,00 | 96 | 13,10 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 56 456 | 2 168 | ||||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | XML Financial, LLC | 17 805 | 1,19 | 684 | 0,29 | ||||

| 2025-07-17 | 13F | Genesis Private Wealth, Llc | 6 047 | 232 | ||||||

| 2025-08-14 | 13F | Alaska Permanent Fund Corp | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Crews Bank & Trust | 740 | 0,00 | 28 | 0,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2 818 481 | 96,72 | 108 230 | 95,00 | ||||

| 2025-08-13 | 13F | F/M Investments LLC | 47 769 | 6,44 | 1 834 | 5,53 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 32 889 | −9,69 | 1 263 | −10,50 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 500 | 0,00 | 19 | 0,00 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 221 | 38,12 | 9 | 33,33 | ||||

| 2025-05-12 | 13F | Invesco Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Roberts Wealth Advisors, LLC | 84 194 | 4,79 | 3 233 | 3,89 | ||||

| 2025-08-11 | 13F | Frank, Rimerman Advisors LLC | 7 461 | 287 | ||||||

| 2025-08-11 | 13F | Avantax Planning Partners, Inc. | 9 850 | −5,01 | 378 | −5,74 | ||||

| 2025-08-14 | 13F | Voya Financial Advisors, Inc. | 33 972 | 17,64 | 1 311 | 17,17 | ||||

| 2025-08-14 | 13F | Kahn Brothers Group Inc /de/ | 659 872 | 4,40 | 25 339 | −7,38 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 329 364 | −0,82 | 12 648 | −1,69 | ||||

| 2025-06-26 | NP | FVLAX - Fidelity Advisor Value Leaders Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 7 200 | 287 | ||||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 75 758 | −7,76 | 2 814 | −11,54 | ||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 5 825 | 1,32 | 224 | 0,45 | ||||

| 2025-08-08 | 13F | IMA Wealth, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | SkyView Investment Advisors, LLC | 7 849 | 0 | ||||||

| 2025-06-26 | NP | FBCVX - Fidelity Blue Chip Value Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 153 700 | 6 125 | ||||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 3 323 | 0,00 | 128 | −0,78 | ||||

| 2025-07-31 | 13F | Ingalls & Snyder Llc | 19 019 | −0,83 | 1 | |||||

| 2025-08-15 | 13F | First Heartland Consultants, Inc. | 10 831 | 19,49 | 416 | 18,23 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 3 156 875 | 81,81 | 121 224 | 80,22 | ||||

| 2025-08-15 | 13F | Optimist Retirement Group LLC | 57 446 | −5,43 | 2 206 | −6,29 | ||||

| 2025-08-05 | 13F | Texas Bank & Trust Co | 6 699 | 257 | ||||||

| 2025-07-18 | 13F | Centricity Wealth Management, LLC | 658 | 0,61 | 25 | 0,00 | ||||

| 2025-08-07 | 13F | Flagship Wealth Advisors, Llc | 1 122 | 0,45 | 43 | 0,00 | ||||

| 2025-08-08 | 13F | Bailard, Inc. | 21 321 | 11,81 | 819 | 10,84 | ||||

| 2025-08-12 | 13F | Saturna Capital CORP | 22 658 | 0,04 | 870 | −0,80 | ||||

| 2025-08-11 | 13F | Great Lakes Advisors, Llc | 32 006 | 1 229 | ||||||

| 2025-07-09 | 13F | Thrive Wealth Management, LLC | 9 077 | −0,69 | 349 | −1,69 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 4 621 | 28,29 | 177 | |||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 9 354 | −4,11 | 359 | −4,77 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 22 209 | 20,68 | 853 | 19,66 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 12 781 | −11,87 | 491 | −12,66 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 886 826 | 39,01 | 34 054 | 37,79 | ||||

| 2025-04-25 | NP | FGIRX - Fidelity Advisor Growth & Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 292 647 | 18,41 | 11 001 | 30,41 | ||||

| 2025-04-03 | 13F | First Hawaiian Bank | 101 039 | 18,80 | 3 914 | 36,09 | ||||

| 2025-05-07 | 13F | Integrated Investment Consultants, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 19 741 | −2,30 | 758 | −3,07 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 15 140 | −0,57 | 581 | −1,36 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | National Wealth Management Group, LLC | 10 656 | 413 | ||||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 81 069 | −7,94 | 3 231 | 4,03 | ||||

| 2025-08-08 | 13F | Meridian Wealth Management, LLC | 6 476 | 4,94 | 249 | 3,77 | ||||

| 2025-07-21 | 13F | Barrett & Company, Inc. | 2 840 | −5,11 | 109 | −5,22 | ||||

| 2025-07-31 | 13F | Ground Swell Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 431 256 | 7,26 | 16 560 | 6,32 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 70 173 | −21,19 | 2 695 | −21,89 | ||||

| 2025-07-24 | 13F | Reuter James Wealth Management, Llc | 18 806 | 722 | ||||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 584 | −5,96 | 22 | −8,33 | ||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 8 136 | −4,56 | 312 | −5,45 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Europe 1.25x Strategy Fund Variable Annuity | 364 | −43,21 | 14 | −45,83 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 685 | 0,00 | 0 | |||||

| 2025-07-29 | 13F | Dumont & Blake Investment Advisors Llc | 12 587 | 3,67 | 483 | 2,77 | ||||

| 2025-08-14 | 13F | SWAN Capital LLC | 399 | 42,50 | 15 | 50,00 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 354 734 | 2,44 | 13 622 | 1,54 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 654 | 0,15 | 25 | 0,00 | ||||

| 2025-08-14 | 13F | Guardian Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | FIL Ltd | 878 | 5,28 | 34 | 3,13 | ||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 232 | 9 | ||||||

| 2025-08-20 | NP | HWCIX - Hotchkis & Wiley Diversified Value Fund Class I | 9 940 | −3,87 | 382 | −4,75 | ||||

| 2025-07-08 | 13F | Bard Financial Services, Inc. | 134 745 | 10,23 | 5 174 | 9,27 | ||||

| 2025-05-02 | 13F | Cable Hill Partners, LLC | 6 993 | 279 | ||||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 160 | −64,04 | 6 | −64,71 | ||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 5 319 | −5,07 | 204 | −5,99 | ||||

| 2025-07-29 | 13F | United Bank | 35 273 | 9,12 | 1 354 | 8,15 | ||||

| 2025-07-24 | 13F | Eastern Bank | 1 028 | −27,91 | 39 | −29,09 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 12 744 | −26,93 | 489 | −27,56 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 16 280 | −0,16 | 625 | −0,95 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 762 741 | −30,28 | 29 289 | −30,89 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 6 065 | 233 | ||||||

| 2025-07-17 | 13F | Chicago Capital, LLC | 7 287 | 0,00 | 280 | −1,06 | ||||

| 2025-08-12 | 13F | Cravens & Co Advisors, LLC | 7 759 | 2,24 | 298 | 1,37 | ||||

| 2025-07-30 | NP | SEEFX - Saturna Sustainable Equity Fund | 9 200 | 0,00 | 377 | 9,28 | ||||

| 2025-08-05 | 13F | Verity Asset Management, Inc. | 18 095 | 6,79 | 695 | 5,79 | ||||

| 2025-08-06 | 13F | Nicholas Hoffman & Company, LLC. | 47 633 | −0,40 | 1 829 | −1,24 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 375 481 | 4,74 | 14 418 | 3,82 | ||||

| 2025-08-14 | 13F | Prestige Wealth Management Group LLC | 80 | 0,00 | 3 | 0,00 | ||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 13 160 | 505 | ||||||

| 2025-07-24 | 13F | PDS Planning, Inc | 6 177 | −1,28 | 237 | −2,07 | ||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 2 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Royal Fund Management, LLC | 29 272 | 13,59 | 1 124 | 12,51 | ||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 1 767 435 | 5,21 | 67 870 | 4,29 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 39 441 | 65,27 | 1 618 | 80,38 | ||||

| 2025-06-26 | NP | LSVMX - LSV U.S. MANAGED VOLATILITY FUND Institutional Class Shares | 5 800 | 0,00 | 231 | 13,24 | ||||

| 2025-07-02 | 13F | Norway Savings Bank | 8 598 | 330 | ||||||

| 2025-06-27 | NP | POGRX - PRIMECAP Odyssey Growth Fund | 868 700 | −10,15 | 34 618 | 1,52 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6 294 992 | −30,54 | 241 728 | −31,15 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 1 336 | 0,00 | 51 | 0,00 | ||||

| 2025-08-12 | 13F | Atalanta Sosnoff Capital, Llc | 7 125 | 3,04 | 274 | 2,25 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Call | 1 800 000 | 0,00 | 69 120 | −0,88 | |||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 271 580 | −33,07 | 10 429 | −33,66 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 11 997 | 461 | ||||||

| 2025-04-25 | 13F | Smallwood Wealth Investment Management, LLC | 178 | 7 | ||||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 64 218 | 10,68 | 2 413 | 7,39 | ||||

| 2025-08-12 | 13F | Gitterman Wealth Management, LLC | 3 256 | 125 | ||||||

| 2025-08-26 | NP | GOLDMAN SACHS VARIABLE INSURANCE TRUST - Goldman Sachs International Equity Insights Fund Institutional | 19 105 | −40,93 | 734 | −41,50 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 256 307 | 6,36 | 9 842 | 5,43 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 31 713 | 52,65 | 1 218 | 51,37 | ||||

| 2025-08-11 | 13F | Integrated Quantitative Investments LLC | 79 030 | 3 035 | ||||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 18 708 | 5,59 | 718 | 4,66 | ||||

| 2025-05-23 | NP | Guardian Variable Products Trust - Guardian Balanced Allocation VIP Fund | 8 007 | −16,51 | 310 | −4,32 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 14 155 | 0,00 | 544 | −0,91 | ||||

| 2025-08-07 | 13F | Gryphon Financial Partners LLC | 7 846 | 28,75 | 301 | 27,54 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 10 243 | 318,77 | 396 | 321,28 | ||||

| 2025-07-11 | 13F | Thomasville National Bank | 871 653 | −0,61 | 33 471 | −1,48 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 39 228 | 13,54 | 1 506 | 12,56 | ||||

| 2025-08-13 | 13F | Holos Integrated Wealth LLC | 32 | 0,00 | 1 | 0,00 | ||||

| 2025-08-07 | 13F | Midwest Trust Co | 133 859 | 5 140 | ||||||

| 2025-06-27 | NP | ZABDFX - American Beacon Diversified Fund AAL Class | 10 500 | −13,22 | 418 | −1,88 | ||||

| 2025-08-04 | 13F | Twin City Private Wealth, Llc | 42 747 | 3,05 | 1 660 | 2,09 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 109 661 | 7,36 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 2 927 | −4,87 | 112 | −5,88 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 20 678 | −0,61 | 805 | 2,29 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 2 824 745 | −29,07 | 108 | −29,87 | ||||

| 2025-07-17 | 13F | San Luis Wealth Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 5 375 | −43,83 | 208 | −44,05 | ||||

| 2025-05-14 | 13F | Summit Financial Wealth Advisors, LLC | 6 194 | 240 | ||||||

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 9 212 | −22,31 | 354 | −23,09 | ||||

| 2025-06-27 | NP | DSEFX - Domini Impact Equity Fund Investor Shares | 65 900 | 0,00 | 2 626 | 12,99 | ||||

| 2025-05-13 | 13F | Raymond James Financial Inc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-24 | 13F | Horizon Bancorp Inc /in/ | 3 791 | −2,67 | 0 | |||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Transce3nd, LLC | 28 | 0,00 | 1 | 0,00 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 17 815 | −6,55 | 684 | −7,32 | ||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-03-26 | NP | ALBAX - Alger Growth & Income Fund Class A | 39 459 | 0,00 | 1 392 | −4,07 | ||||

| 2025-07-22 | 13F | BridgePort Financial Solutions, LLC | 8 415 | 1,04 | 323 | 0,31 | ||||

| 2025-04-22 | 13F | Atticus Wealth Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Five Oceans Advisors | 6 303 | 10,91 | 242 | 10,00 | ||||

| 2025-08-15 | 13F/A | Rakuten Securities, Inc. | 10 | −9,09 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 5 174 255 | −2,66 | 198 692 | −3,51 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 18 087 | 4,39 | 695 | 5,31 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 845 | 252,08 | 32 | 255,56 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 213 000 | 4,01 | 8 179 | 3,10 | ||||

| 2025-08-06 | 13F | Equity Investment Corp | 4 192 781 | 0,45 | 161 003 | −0,44 | ||||

| 2025-07-17 | 13F | Alliance Wealth Advisors, LLC | 9 240 | 0,71 | 355 | −0,28 | ||||

| 2025-08-14 | 13F | Crawford Investment Counsel Inc | 660 688 | 119,58 | 25 370 | 117,66 | ||||

| 2025-07-30 | 13F | Sentry LLC | 7 468 | 0,00 | 287 | −1,04 | ||||

| 2025-08-12 | 13F | Choate Investment Advisors | 28 936 | 6,59 | 1 111 | 5,71 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 8 807 | 7,21 | 338 | 6,29 | ||||

| 2025-07-30 | NP | FCTDX - Strategic Advisers Fidelity U.S. Total Stock Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 7 372 027 | 2,49 | 302 474 | 11,87 | ||||

| 2025-08-15 | 13F | Krensavage Asset Management, LLC | 271 729 | −0,10 | 10 | 0,00 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 13 488 | −2,23 | 518 | −3,18 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 155 | −37,50 | 6 | −33,33 | ||||

| 2025-08-12 | 13F | Northstar Financial Companies, Inc. | 6 735 | 0,00 | 259 | −0,77 | ||||

| 2025-07-30 | NP | FSAKX - Strategic Advisers U.S. Total Stock Fund | 156 266 | −8,37 | 6 412 | 0,02 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 184 184 | 7 073 | ||||||

| 2025-07-14 | 13F | Bank & Trust Co | 272 | −12,82 | 10 | −16,67 | ||||

| 2025-07-22 | 13F | VAUGHAN & Co SECURITIES, INC. | 18 639 | −0,37 | 716 | −1,24 | ||||

| 2025-08-13 | 13F | Stablepoint Partners, LLC | 123 294 | 2,07 | 4 734 | 1,18 | ||||

| 2025-08-06 | 13F | Yelin Lapidot Holdings Management Ltd. | 364 053 | −9,98 | 13 980 | −10,77 | ||||

| 2025-04-02 | 13F | Marcum Wealth, LLC | 9 373 | 0,07 | 363 | 14,87 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 1 004 799 | −6,63 | 38 584 | −7,45 | ||||

| 2025-06-27 | NP | DIVD - Altrius Global Dividend ETF | 4 420 | 44,44 | 176 | 64,49 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 355 | −4,05 | 14 | −7,14 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 62 082 | 9,11 | 2 384 | 8,17 | ||||

| 2025-08-13 | 13F | Nicolet Advisory Services, Llc | 15 097 | 5,69 | 567 | 18,37 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 21 447 | 4,35 | 824 | 3,39 | ||||

| 2025-07-15 | 13F | First City Capital Management, Inc. | 5 234 | 0,19 | 201 | −0,99 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 112 582 | −4,74 | 4 | 0,00 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 13 271 | −7,71 | 1 | |||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 139 607 | 13,69 | 5 361 | 12,68 | ||||

| 2025-07-17 | 13F | Stockman Wealth Management, Inc. | 261 321 | 1,60 | 10 035 | 0,71 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Europe 30 | 16 358 | 2,98 | 628 | 2,11 | ||||

| 2025-08-06 | 13F | Simmons Bank | 57 213 | 2,59 | 2 197 | 1,67 | ||||

| 2025-05-14 | 13F | South Plains Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 28 614 | 114,64 | 1 099 | 112,79 | ||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 1 661 268 | 2,58 | 63 793 | 1,68 | ||||

| 2025-06-26 | NP | Elevation Series Trust - The Opal International Dividend Income ETF | 74 462 | 633,47 | 2 967 | 728,77 | ||||

| 2025-07-29 | 13F | Aspiriant, Llc | 8 119 | −1,48 | 312 | −2,51 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 163 434 | −4,35 | 6 276 | −5,20 | ||||

| 2025-04-25 | 13F | EnRich Financial Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 277 379 | 172,20 | 10 651 | 169,85 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 16 084 | 42,84 | 618 | 41,51 | ||||

| 2025-06-25 | NP | TRIGX - T. Rowe Price International Value Equity Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 181 858 | 1,18 | 126 797 | 14,32 | ||||

| 2025-06-26 | NP | FDVKX - Fidelity Value Discovery K6 Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 58 759 | −4,82 | 2 342 | 7,53 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 6 121 | 12,83 | 0 | |||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 8 176 | 0,00 | 314 | −0,95 | ||||

| 2025-08-07 | 13F | Legacy Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 12 265 | 4,07 | 471 | 3,07 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 14 038 | 38,84 | 539 | 37,85 | ||||

| 2025-08-11 | 13F | Pineridge Advisors LLC | 3 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 20 698 | 22,79 | 795 | 21,59 | ||||

| 2025-07-29 | 13F | Aull & Monroe Investment Management Corp | 6 488 | −2,41 | 249 | −3,11 | ||||

| 2025-07-29 | NP | GBFFX - GMO Benchmark-Free Fund Class III | 74 625 | −17,15 | 3 062 | −9,57 | ||||

| 2025-05-13 | 13F | FineMark National Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Atom Investors LP | 79 152 | 3 039 | ||||||

| 2025-08-26 | NP | TFPN - Blueprint Chesapeake Multi-Asset Trend ETF | 10 055 | −144,66 | 386 | −150,72 | ||||

| 2025-04-30 | 13F | POM Investment Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 277 | 0,00 | 11 | 0,00 | ||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 8 800 | −9,41 | 338 | −10,11 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 1 032 | −24,28 | 40 | −25,00 | ||||

| 2025-07-30 | 13F | Lafayette Investments, Inc. | 23 300 | 0,00 | 895 | −0,89 | ||||

| 2025-08-07 | 13F | Nwam Llc | 13 340 | 7,42 | 520 | 7,90 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 46 053 | −3,44 | 1 768 | −4,28 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 45 | −91,73 | 2 | −95,24 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 7 370 | 3 512,75 | 283 | 3 942,86 | ||||

| 2025-04-18 | 13F | Pacific Capital Wealth Advisors, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Diversified Value Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 62 832 | −15,58 | 2 413 | −16,34 | ||||

| 2025-07-08 | 13F | Ransom Advisory, Ltd | 3 893 | 0,00 | 149 | −0,67 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 44 521 | 20,83 | 1 710 | 37,16 | ||||

| 2025-05-15 | 13F | Soleus Capital Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Harvest Portfolios Group Inc. | 50 200 | 0,00 | 1 928 | −0,87 | ||||

| 2025-08-05 | 13F | Centennial Bank/AR/ | 164 | 6 | ||||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 7 197 | 267 | ||||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 19 752 | −0,95 | 772 | 13,03 | ||||

| 2025-05-30 | NP | SMINX - SIMT Tax-Managed International Managed Volatility Fund Class F | 1 901 | 0,00 | 74 | 14,06 | ||||

| 2025-07-22 | 13F | Figure 8 Investment Strategies Llc | 15 867 | −6,37 | 609 | −7,16 | ||||

| 2025-05-09 | 13F | Delta Financial Group, Inc. | 7 769 | −1,83 | 0 | |||||

| 2025-07-29 | NP | GMOIX - GMO International Equity Fund Class III | 182 402 | −35,43 | 7 484 | −29,53 | ||||

| 2025-05-15 | 13F | Point72 Asset Management, L.P. | Put | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 3 632 471 | 2 535,78 | 139 487 | 2 513,08 | ||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 1 508 | 0,00 | 58 | −1,72 | ||||

| 2025-08-12 | 13F | Tocqueville Asset Management L.p. | 46 757 | −0,30 | 1 795 | −1,16 | ||||

| 2025-07-08 | 13F | Range Financial Group LLC | 17 198 | 88,26 | 660 | 86,97 | ||||

| 2025-05-05 | 13F | Creekmur Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 239 353 | 459,64 | 85 991 | 454,74 | ||||

| 2025-07-15 | 13F | Kempner Capital Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Lifeworks Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Everstar Asset Management, LLC | 15 420 | 3,40 | 592 | 2,60 | ||||

| 2025-07-30 | NP | SCORX - Sextant Core Fund | 4 200 | 0,00 | 172 | 9,55 | ||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 210 | −61,61 | 8 | −61,90 | ||||

| 2025-08-27 | NP | VPMCX - Vanguard PRIMECAP Fund Investor Shares | 19 891 050 | 9,79 | 763 816 | 8,82 | ||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 7 301 | −15,83 | 280 | −16,67 | ||||

| 2025-08-14 | 13F | Holocene Advisors, LP | 5 609 531 | 5,74 | 215 406 | 4,81 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 6 583 | 2,75 | 253 | 1,61 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 227 341 | 0,00 | 9 060 | 12,98 | ||||

| 2025-07-16 | 13F | Old Port Advisors | 64 564 | 3,14 | 2 479 | 2,23 | ||||

| 2025-07-31 | 13F | Brighton Jones Llc | 5 987 | 230 | ||||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 8 369 | −0,36 | 359 | 15,11 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 29 069 | 3 740,03 | 1 | −100,00 | ||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 25 237 | 53,15 | 1 035 | 67,21 | ||||

| 2025-06-25 | NP | EPDPX - EuroPac International Dividend Income Fund Class A | 55 000 | 0,00 | 2 192 | 13,00 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 49 774 | 3,87 | 1 933 | 2,77 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 10 325 | 2,74 | 396 | 1,80 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-07 | 13F | Trust Co | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 379 | 18,44 | 15 | 16,67 | ||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Clean Yield Group | 167 388 | −6,55 | 6 428 | −7,37 | ||||

| 2025-07-22 | 13F | Jamison Private Wealth Management, Inc. | 17 260 | −1,30 | 663 | −2,22 | ||||

| 2025-08-28 | NP | DODGX - Dodge & Cox Stock Fund | 58 412 777 | 0,00 | 2 243 051 | −0,88 | ||||

| 2025-06-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 665 109 | 0,00 | 26 505 | 12,98 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 1 | 0 | ||||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Hotchkis & Wiley Large-cap Value Portfolio | 81 321 | 0,00 | 3 123 | −0,89 | ||||

| 2025-07-16 | 13F | Ipswich Investment Management Co., Inc. | 8 964 | 10,61 | 344 | 9,90 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 65 229 | 38,33 | 2 505 | 57,09 | ||||

| 2025-08-13 | 13F | Advisory Research Inc | 240 421 | 5,80 | 9 232 | 4,87 | ||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 198 | 0,00 | 8 | 0,00 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 410 | −24,91 | 16 | −28,57 | ||||

| 2025-04-28 | 13F | Meritage Portfolio Management | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-21 | 13F | Old Second National Bank Of Aurora | 600 | 0,00 | 23 | 0,00 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 3 155 | 209,01 | 121 | 210,26 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | −100,00 | 0 | |||||

| 2025-06-18 | NP | RETSX - Tax-Managed U.S. Large Cap Fund Class S | 521 237 | −21,50 | 20 771 | −11,30 | ||||

| 2025-06-26 | NP | AMRMX - AMERICAN MUTUAL FUND Class A | 1 722 336 | −0,28 | 68 635 | 12,67 | ||||

| 2025-06-27 | NP | KEAT - Keating Active ETF | 76 182 | 2,24 | 3 036 | 15,49 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 39 685 | 0,00 | 1 524 | −0,91 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 1 612 | 18,88 | 62 | 16,98 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 9 486 | −27,15 | 364 | −27,78 | ||||

| 2025-06-25 | NP | EPIVX - EuroPac International Value Fund Class A | 55 760 | 0,00 | 2 222 | 13,02 | ||||

| 2025-08-26 | NP | Forethought Variable Insurance Trust - Global Atlantic Wellington Research Managed Risk Portfolio | 10 235 | −2,63 | 393 | −3,44 | ||||

| 2025-08-13 | 13F | Tranquilli Financial Advisor LLC | 6 802 | 19,19 | 261 | 18,10 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 1 454 709 | −24,15 | 55 861 | −24,82 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 1 196 | −98,01 | 46 | −13,46 | ||||

| 2025-07-24 | 13F | Drucker Wealth 3.0, LLC | 51 450 | −36,44 | 2 009 | −35,95 | ||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 8 967 | 344 | ||||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 66 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 89 500 | 0,00 | 3 437 | −0,89 | ||||

| 2025-08-22 | NP | FENI - Fidelity Enhanced International ETF | 370 932 | 30,48 | 14 244 | 29,33 | ||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | 960 | 0,00 | 37 | −2,70 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 25 073 | −20,59 | 963 | −21,34 | ||||

| 2025-07-24 | 13F | Aurora Private Wealth, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | JTC Employer Solutions Trusteee Ltd | 14 997 384 | −1,72 | 576 | −2,71 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 8 822 | 7,31 | 339 | 6,29 | ||||

| 2025-08-13 | 13F | Trustmark National Bank Trust Department | 8 566 | 0,82 | 329 | −0,30 | ||||

| 2025-08-13 | 13F | West Family Investments, Inc. | 10 119 | 54,58 | 389 | 53,36 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 7 049 | 0,33 | 271 | −0,74 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 58 184 | 8,55 | 2 234 | 7,61 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 33 217 | −1,11 | 1 276 | −2,00 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 467 | 90,61 | 18 | 88,89 | ||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 3 783 | −2,22 | 145 | −2,68 |